At first glance, Treasurer Scott Morrison’s plan to slash $83.7 million from the ABC operating budget seems mean-spirited. At second glance, when he tells reporters ‘everyone has to live within their means’, it still seems mean-spirited.

The Budget proposal comes at a critical time for the ABC, which has been dealing with cumulative cuts of $254 million since 2014.

The Federal Treasurer, having painted the picture large, sent a hospital pass to Finance Minister Mathias Cormann to handle the outrage. Mr Cormann defended the decision to freeze indexation for three years (which amounts to $83.7 million), saying that all taxpayer-funded organisations have to find efficiencies.

The national broadcaster has been tightening its belt so much there is no room left for another notch. Managing director Michelle Guthrie sent an email to all staff saying as much, which she amplified in a press release. Ms Guthrie said the impact of the decision could not be absorbed by efficiency measures alone, as the ABC had already achieved significant productivity gains in response to past budget cuts.

She referred to Budget measures starting in 2014 with a 20% cut to the operating budget. The ABC was told to slash $254 million from its operating budget within five years. The broadcaster began to make cuts which were expected to save $207 million in 2015.

Jobs were lost, through natural attrition or redundancy, and the ABC also started reviewing its property portfolio and transmission network. As I have written previously, there was a general hubbub of protestation about this, circa November 2014.

“Petitioners were petitioning, GetUp was getting up, the ABC Friends group was lobbying and raising funds. They should have seen it coming,” I wrote.

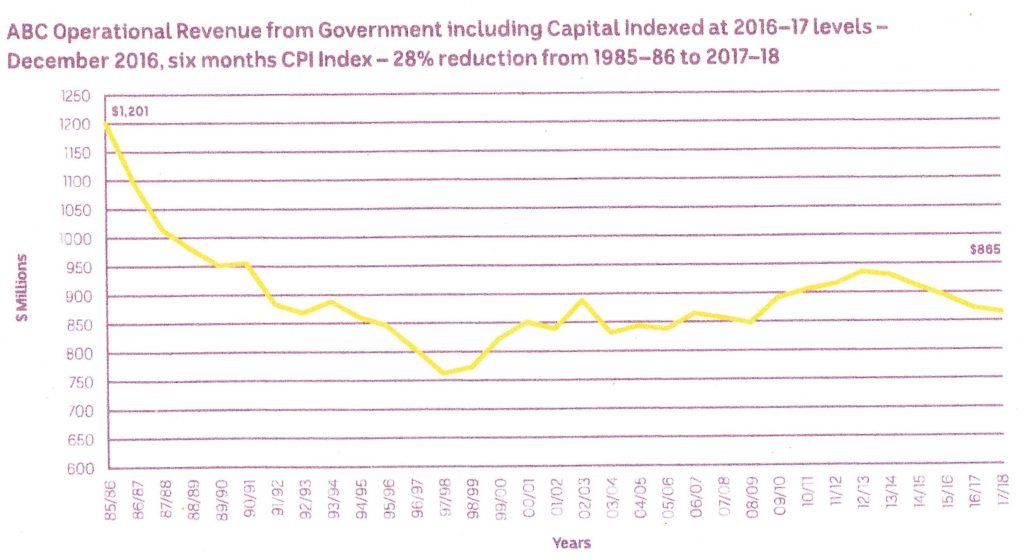

A graph in the ABC’s latest annual report (above) shows how its operational budget has waxed and waned, dropping 28% from 1985-1986 to 2017-2018. As the graph indicates, the ABC has weathered some very lean years, particularly 1997-1998, under John Howard and Peter Costello.

The ABC annual report says 2017–18 was the third year to reflect previously announced Government-funding reductions. As part of the ABC/SBS Additional Efficiency Savings measure, there was a year on year increase of $7.7 million in the cut to the ABC’s base funding, bringing the total decrease in base funding to $55.2 million per annum.

This week Ms Guthrie said the ABC was continuing to implement various savings initiatives to address funding cuts, comprising efficiency savings in support functions and transmission (to cover the previously budgeted reduction of $12.5 million required in 2018–19).

Back to the drawing board, then.

Ms Guthrie said the decision came at a critical time for the ABC, as it starts triennial funding negotiations with the Government.

“The ABC is now more important than ever, given the impact of overseas players in the local media industry and the critical role the ABC plays as Australia’s most trusted source of news, analysis and investigative journalism.”

There is also a risk that the Enhanced Newsgathering initiative will not be renewed (at a cost of $43 million). The ABC acknowledges a decision on this funding is yet to be made by the Government. Considering the hullabaloo that followed economic reporter Emma Alberici’s analysis of the government’s plan to cut corporate tax rates, these financial constraints must be seen as ideological and punitive.

Opposition leader Bill Shorten said the ABC was “one of the pet hates of the Liberal Party”, and it’s hard to disagree.

“Because the ABC occasionally asks questions of the government they’re going to wind back $83 million,” he told the ABC.

But Finance Minister Mathias Cormann says the ABC will still receive $3.2 billion over those three years.

“This is effectively equivalent to the efficiency dividend that applies to nearly all other government taxpayer-funded organisations,” he added.

One of the early victims of successive budget cuts was the ABC Fact Check Unit, which was closed down in May 2016. ABC news director Gaven Morris said at the time “Unfortunately, having a standalone unit is no longer viable in the current climate.”

In March 2017, however, the unit was revived as a joint venture between RMIT University and the ABC. The unit’s brief, as it was before, is to ‘test and adjudicate on the accuracy of claims made by politicians, public figures, advocacy groups and institutions engaged in public debate’.

Which governments taxed us the most?

You may have seen an infographic on social media which the Fact Check Unit verified. It shows which governments taxed us the most, spanning the years between Whitlam and Turnbull. Tax as a percentage of GDP peaked in the Howard years at 23.5%. The Whitlam years averaged 19.4%. The Abbott/Turnbull years thus far average 21.7%. Interestingly, the turbulent years of Rudd/Gillard/Rudd averaged 20.9%.

So isn’t it satisfying to publish information like that and know it has been fact-checked and found to be factual? In this era where fake news and what I’d call ‘sponsored news’ leaves us with a skewed perspective, it is refreshing to see the ABC has found a new way to maintain standards.

There were some moments in the Federal Budget one could choose to laud; tax cuts, better reverse mortgage opportunities for pensioners and more funding for the homeless, albeit dependent on State contributions. But there was no respite for people on NewStart and no real plan to address housing affordability.

And, as the Climate Council pointed out, there was nothing at all in the Budget to address climate change – the words were not even mentioned.

For perspective, take a moment to think about the Federal Treasurer’s $50 million plan to redevelop the Meeting Place Precinct in Botany Bay (including a $3 million statue of Captain James Cook). Yes, it’s in Mr Morrison’s electorate, but surely that’s a side issue, Leigh?

If I may revisit an idea from Simple as ABC in 2014, the budgetary travails of the ABC and the ideology motivating it could simply be avoided. All it would take is an annual public radio/TV licence; $35 per household per year would (now) raise about $300 million. If the government of the day would guarantee indexed funding of $1 billion a year, the ABC could plan, rebuild and restore quality for the long-term.

Let’s be reminded that we all paid a radio licence from 1920 and continued doing so until colour TV was introduced in the early 1970s. Not every household in Australia would be happy about paying this licence fee. Some would see it as subsidising those dangerous lefties and bleeding hearts at the ABC and SBS.

But something radical needs to happen, to arrest the decline in quality (e.g. ABC online), restore transmission to remote areas (try getting an ABC station on your car radio when travelling in country areas-Ed.) and ensure money can be found for important investigations.

Every week since 1961 the award-winning Four Corners has continued to unearth important stories. Investigative journalism is an expensive business which requires reliable funding and a relatively free hand.

If we want more important stories like the live sheep export scandal, the solution is simple as ABC: We need to consistently fund the national broadcaster and guarantee its editorial independence.

Further reading: Mr Denmore thinks the media should boycott the Budget Lockup:

http://bobwords.com.au/simple-abc/

http://bobwords.com.au/simple-abc-part-2/

Since we’re discussing Facebook and who has the rights to personal information you’ve posted, I wanted to show you my ‘Wall.’ People used to call their Facebook page their ‘Wall’, though that has become passe. As walls go, this one would be ‘liked’ by Shirley Valentine fans (cultural reference), as it suggests romance and sun-bleached beaches.

Since we’re discussing Facebook and who has the rights to personal information you’ve posted, I wanted to show you my ‘Wall.’ People used to call their Facebook page their ‘Wall’, though that has become passe. As walls go, this one would be ‘liked’ by Shirley Valentine fans (cultural reference), as it suggests romance and sun-bleached beaches.

In our 20th year of presenting house concerts we are pleased to welcome back internationally renowned folk group Cloudstreet. The Brisbane trio return to Maleny on Sunday April 22, their sixth appearance as guests of The Goodwills (Bob & Laurel Wilson). Cloudstreet perform New Australian folk music, a combination of Anglo-Celtic and Australian traditional songs and tunes, coupled with trad-styled original songs. Their music is arranged for an array of instruments including guitar, concertina, flute, whistle and fiddle and now includes the fiddle playing and singing of Emma Nixon.

In our 20th year of presenting house concerts we are pleased to welcome back internationally renowned folk group Cloudstreet. The Brisbane trio return to Maleny on Sunday April 22, their sixth appearance as guests of The Goodwills (Bob & Laurel Wilson). Cloudstreet perform New Australian folk music, a combination of Anglo-Celtic and Australian traditional songs and tunes, coupled with trad-styled original songs. Their music is arranged for an array of instruments including guitar, concertina, flute, whistle and fiddle and now includes the fiddle playing and singing of Emma Nixon.